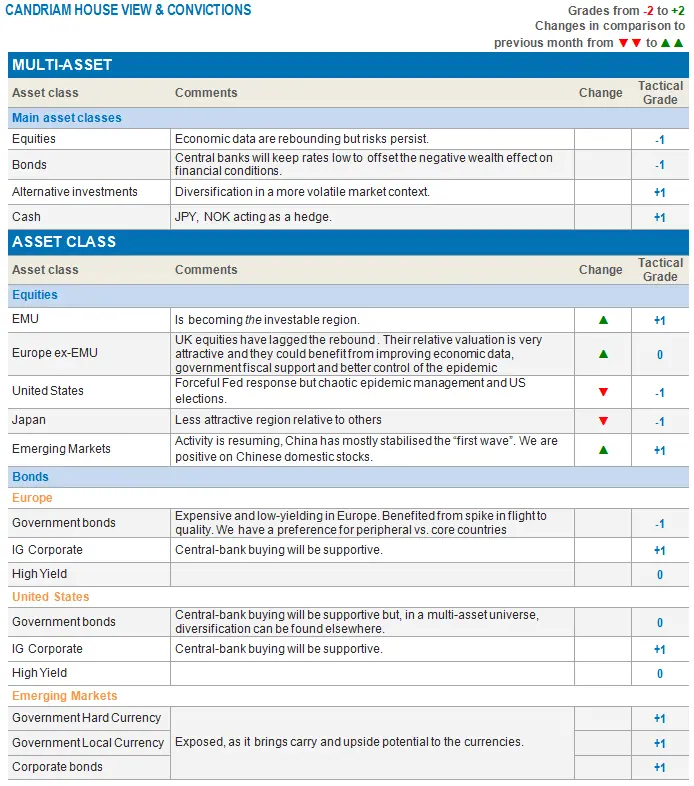

We are witnessing a tug of war in financial markets. On the one hand, we have a better-than-expected economic recovery, still-generous monetary and fiscal support from global central banks, and governments eager to help countries transition into the post-coronavirus-crisis period but, on the other hand, the epidemic threat is far from under control, especially in the US and Brazil. For now, although financial markets will continue to be driven by liquidity and sentiment, the latter is far from being overly optimistic. Let’s see where we stand and how we define our cross-asset strategy, taking these elements into account.

At first glance, economic data are pointing towards a recovery

In this tug of war, the primary driving force is the economic data, which rebounded faster than expected from mid-Q2 2020 in a trend that should continue.

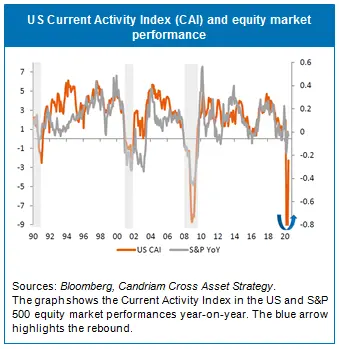

In the major economies, two of the main activity indexes, usually closely correlated to stock markets, both plummeted before starting their recovery.

In the US, this is probably due to the less stringent containment measures but the coronavirus is still widely circulating and healthcare services are overwhelmed. Meanwhile, in Europe, consumption, a key ingredient in the recovery, seem to be rapidly bouncing back after the deep fall in April.

The graph shows the Current Activity Index in the US and S&P 500 equity market performances year-on-year. The blue arrow highlights the rebound.

Likewise, in China, with the epidemic under control and the gradual recovery of external demand, GDP could even retrieve its pre-Covid trajectory by the end of 2020. One of the sine qua non conditions is the continuous support of central banks and governments during the recovery with monetary and fiscal stimuli.

But after all, the epidemic is not under control everywhere

The number of cases is rising fast in the US. The most vulnerable states are those that did not impose strict confinement measures to flatten the curve. This has resulted in the current growing pressure on hospitals, even if the virus is reportedly becoming less severe. Local governments may well decide to strengthen social distancing measures or re-impose partial lockdown measures. Besides the US, the epidemic also seems to be out of control in some emerging countries, especially Brazil, where the president has just tested positive.

Because of the upcoming summer season, which usually signals the beginning of increased leisure travel, there is a clear risk for Europe, as tourists and local populations alike lower their guards.

Does current risk premium offer a cushion against risks?

In the current context, which can be summed up by the contradictory currents of better economic data and abundant liquidity in the midst of an epidemic threat, the equity risk premium has reverted to its historical average. As investors’ risk appetite has slowly replaced their flight to safety, credit spreads have also tightened. The massive intervention from central banks and governments both in amounts and duration is also supportive of financial markets. Sentiment is not excessively optimistic and cash is only starting to exit money market funds. In that regard, it seems like risky assets should continue to be pulled by this liquidity boom and the progressively improving investor sentiment. This should continue to favour lagging stocks and sectors (value) and cyclicals in the current economic rebound.

Risks include the upcoming US elections, which should trigger some volatility in the second half of the year, if history is any guide.

Our current multi-asset strategy

Our overall equity exposure has stayed slightly cautious, due to obvious risks, and we are continuing to protect European and US equities via options and portfolio hedges (gold and Yen).

To benefit from the on-going economic recovery, we have decided to increase our cyclical and value exposure via a long Europe & EM vs US and Japanese equities.

We have not changed our allocation to bonds and remain positive on credit Investment Grade (Europe and US) and emerging debt.

We are also maintaining a short duration bias and an underweight exposure to government bonds in Europe (on core countries)

Our currency allocation is neutral on the USD Vs. EUR and long on NOK Vs. EUR.